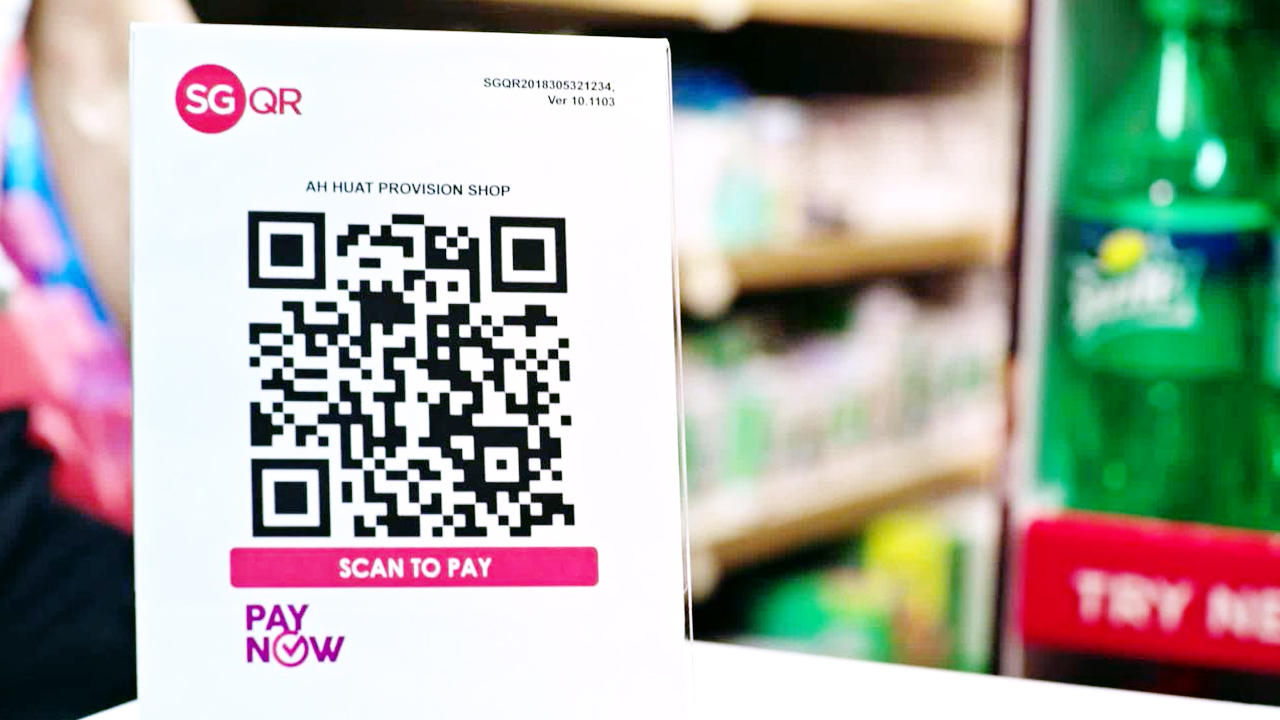

Specifically, the countries involved in this collaboration are Malaysia, Indonesia, Thailand, Singapore, and the Philippines. It is unknown as of yet if other ASEAN countries will join the fray in the future, with the linkage between the region’s five biggest economies announced by Bank Indonesia Governor Perry Warjiyo during a G20 meeting in Bali. That being said, the integration is not yet complete, with a target of November for the five countries to sign a deal that links their payment systems. As of now, Malaysia, Indonesia, and Thailand, are already connected to each other and have enabled cross-border payments using QR codes. Singapore and Malaysia have already signed a deal to link PayNow and DuitNow, with the launch being planned for the upcoming fourth quarter. While waiting for that to come to fruition, Touch ‘n Go has gotten ahead of this by enabling cross-border QR code payments with Singapore through its e-Wallet, though it is currently limited to ComfortDelGro taxi services. As for the Philippines, it has already signed a cross-border deal with Singapore last year and is working on a similar agreement with Malaysia and Thailand. Bloomberg reports that the central banks will seek to link the Southeast Asian network with other regional clusters around the world, with plans to also implement the same structure for real-time bank transfers and central bank digital currencies. QR code payments made through the cross-border system will use local currency settlements between the countries instead of using the US dollar as an intermediary. This means that, for example, transactions made in Thailand using an Indonesian app would be directly exchanged between Rupiah and Baht. (Source: Bloomberg)